south dakota vehicle sales tax calculator

South Dakota has a 45 statewide sales tax rate but also has 289 local tax jurisdictions including. Maximum Local Sales Tax.

Sales Use Tax South Dakota Department Of Revenue

You can use our North Dakota Sales Tax Calculator to look up sales tax rates in North Dakota by address zip code.

. Average Local State Sales Tax. In addition to taxes. - All sales of vehicles by auction are subject to either sales or use tax or motor vehicle excise tax unless exempt under.

The highest sales tax is in Roslyn with a. Maximum Possible Sales Tax. South Dakota has a 45 statewide sales tax rate.

Tax and Tags Calculator. All car sales in South Dakota are subject to the 4 statewide sales tax. Calculate Car Sales Tax in North Dakota Example.

Auto sales tax and the cost of a new car tag are major factors in any tax title. The state sales tax rate for South Dakota is 45. The county the vehicle is registered in.

The vehicle is exempt from motor vehicle excise tax. Mobile Manufactured homes are subject to the 4 initial. For vehicles that are being rented or leased see see taxation of leases and rentals.

Your household income location filing status and number of personal. For more information on excise. Most services in South Dakota are subject to sales tax with some exceptions in the construction industry.

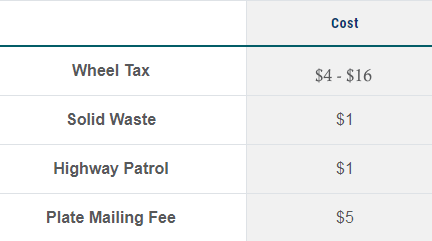

Motor vehicles registered in the State of South Dakota are subject to the 4 motor vehicle excise tax. Counties are allowed to impose an administrative fee for out-of-state and resident applicants titling motor vehicles entirely by mail. Our online services allow you to.

The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. Our income tax calculator calculates your federal state and local taxes based on several key inputs. South Dakota State Sales Tax.

If you make 70000 a year living in the region of south dakota usa you will be taxed 8387. The South Dakota vehicle registration. When purchasing a vehicle the tax and tag fees are calculated based on a number of factors including.

If you are unsure call any local car dealership and ask for the tax rate. The calculator will show you the total sales tax amount as well as the. The sales tax applies to the gross receipts of all retail sales including the sale lease or rental of tangible personal property or any product transferred electronically and the sale of services.

The South Dakota Department of Revenue administers these taxes. Maximum Local Sales Tax. South Dakota collects a 4 state sales tax rate on the purchase of all vehicles.

The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. Municipalities may impose a general municipal sales tax rate of up to 2. They may also impose a 1 municipal gross.

Average Local State Sales Tax. South Dakota State Sales Tax. Maximum Possible Sales Tax.

The Motor Vehicle Division provides and maintains your motor vehicle records. Review and renew your vehicle registrationdecals and license plates. Different areas have varying additional sales taxes as well.

Car Tax By State Usa Manual Car Sales Tax Calculator

New York Sales Tax For Your Auto Dealership

Sales Tax On Cars And Vehicles In South Dakota

What You Need When Selling Your Vehicle To A Private Party South Dakota Department Of Revenue

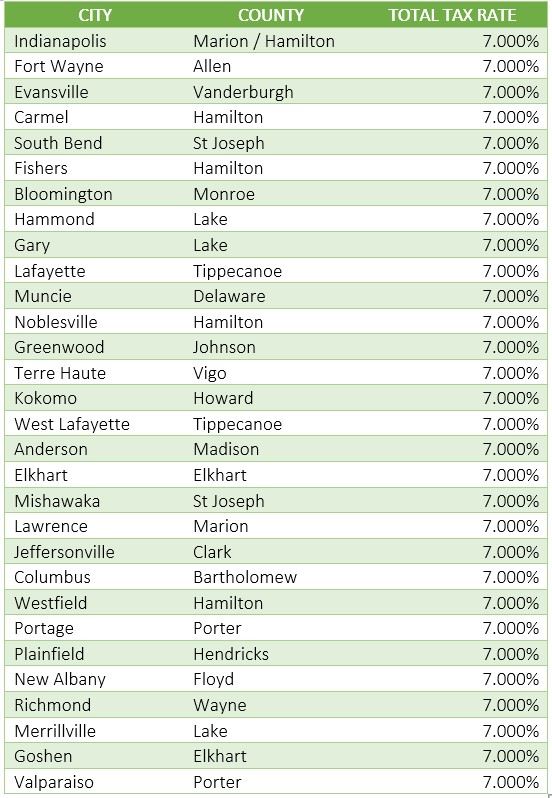

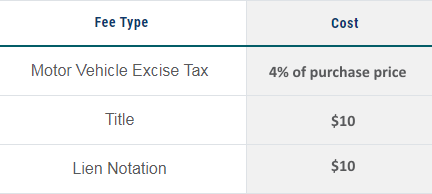

Indiana Sales Tax Guide For Businesses

Vehicle Registration Cost Calculator South Dakota

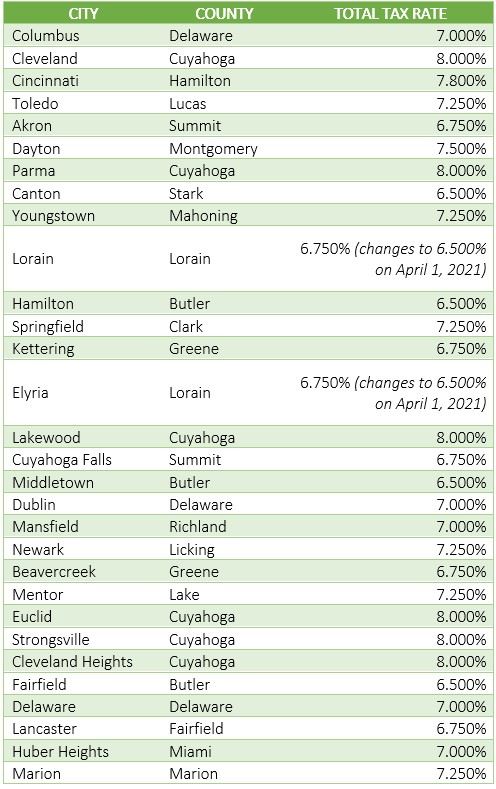

Ohio Sales Tax Guide For Businesses

Vehicle Registration Cost Calculator South Dakota

Car Sales Tax In South Dakota Getjerry Com

Car Tax By State Usa Manual Car Sales Tax Calculator

South Dakota Vehicle Sales Tax Fees Calculator Find The Best Car Price

South Dakota Vehicle Sales Tax Fees Calculator Find The Best Car Price

5 Common Errors When Titling A Vehicle South Dakota Department Of Revenue

Sales Tax Calculator For Purchase Plus Tax Or Tax Included Price

Free Business Sales Tax Calculator Calculate Your Tax Now With Clickfunnels